By: Tom Murray | Managing Director

Facebook and Google are the juggernauts of the advertising industry, and each earnings report from them allow us to look under the hood at how well they are doing, but also potential strategy shifts in the future. Let’s take a deeper dive.

Facebook:

The results:

- $21.08 Billion Revenue (25% Increase from previous year) in Q4 2019

- 2.5 Billion Monthly Active Users (MAU)

- 1.6 Billion Daily Active Users (DAU)

- Expenses up 51% from the previous year to $46.7 Billion

- Instagram accounted for $20 Billion in total revenue for 2019, about 28% of total revenue

What does this mean for Facebook?

More Ads Coming

With ad load maxed out on the key properties such as Facebook Feed and Instagram Feed, more ad placements are likely coming to allow advertisers to buy more impressions across the Facebook ecosystem of apps. The newest placement will likely be Instagram TV (IGTV), as that has been a big push of theirs over the past year or two, but have not started to monetize it yet.

Instagram Will Increase its Share of the Revenue

At 28% of revenue, this has been Facebook’s fastest growing area of revenue growth over the past few years. With Stories being as successful as it has been as a Snapchat clone, that has opened up massive inventory it didn’t have years ago. With 500M users on Stories, that means there are still hundreds of millions of people for it to capture, which will allow it to eventually grow this pool to 30-40% of revenue over the next few years.

Growth Slowdown

This was inevitable. They nearly have the entire world on Facebook (2.5B monthly active users), so growth was going to slow unless Facebook created literal new people. In addition, all the added expenses of adding more content moderators, better systems to stop election fraud, civil unrest, and other issues that have plagued Facebook is adding up. This could also force Facebook to either start raising prices, or open up even more ad placements to account for the increased expenditures.

Google (Just Google, Not All of Alphabet)

The Results:

- YouTube revenue up from $11B in 2018 to over $15 Billion in 2019

- Search business accounted for over $27 Billion in Q4 2019 (and $98 Billion in all of 2019)

- Half of search spend is now via automated bidding

What does this mean for Google?

YouTube is Google’s Instagram

As noted above, Instagram made up around 28% of Facebook’s revenue at over $20 Billion in 2019. YouTube was right behind at around $15 Billion, accounting for almost 16% of Google’s revenue. YouTube is the 2nd largest search engine in the world and a place where many advertisers are starting to push their dollars over to due to its increase in automation and machine learning capabilities to improve performance for not just branding campaigns, but also direct response campaigns.

Times are Changing

With over 50% of their revenue coming from automated bidding, Google has undergone a massive shift in how search ads were bought. Gone are the days of millions of keywords needing to have individual bids and thousands of ad groups. Google has preached consolidation and simpler campaign structures, allowing Google’s machine learning to take over and do most of the grunt and dirty work of finding clicks and eventual buyers. This number will keep increasing year over year as Google’s algorithms get even smarter to an eventual keyword-less Google Adwords world.

Search Ads Overhaul

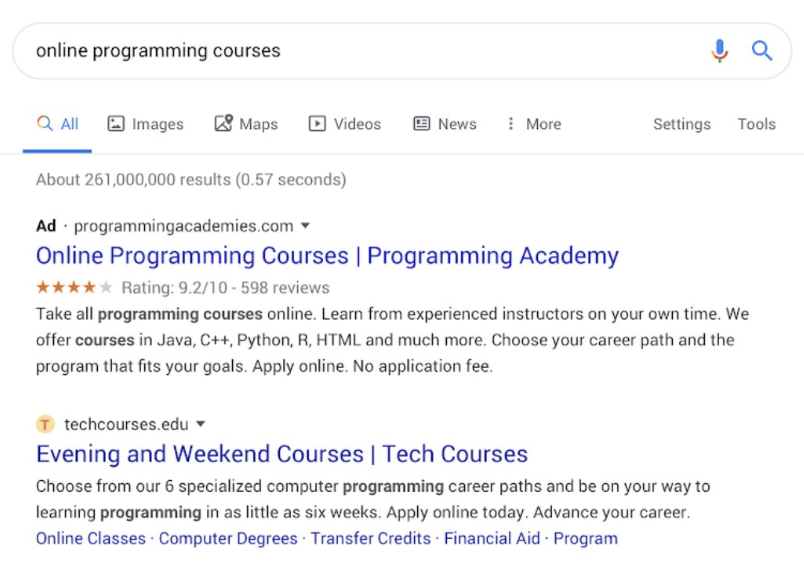

Apparently $98 Billion from search isn’t enough and Google really wants to crack $100 Billion. To do it, they have released (and then walked back) on changes to change the way search ads looks. After years of legislation saying they can’t make search ads look like organic results, their most recent change changes just the favicon to the left of the listing, but has no color shading or box to denote an ad. This would in theory increase clicks on the ads, and then revenue. They’ve since walked it back since there was an uproar, but these slight tweaks will keep happening, causing more and more clicks to come on paid vs. organic results.