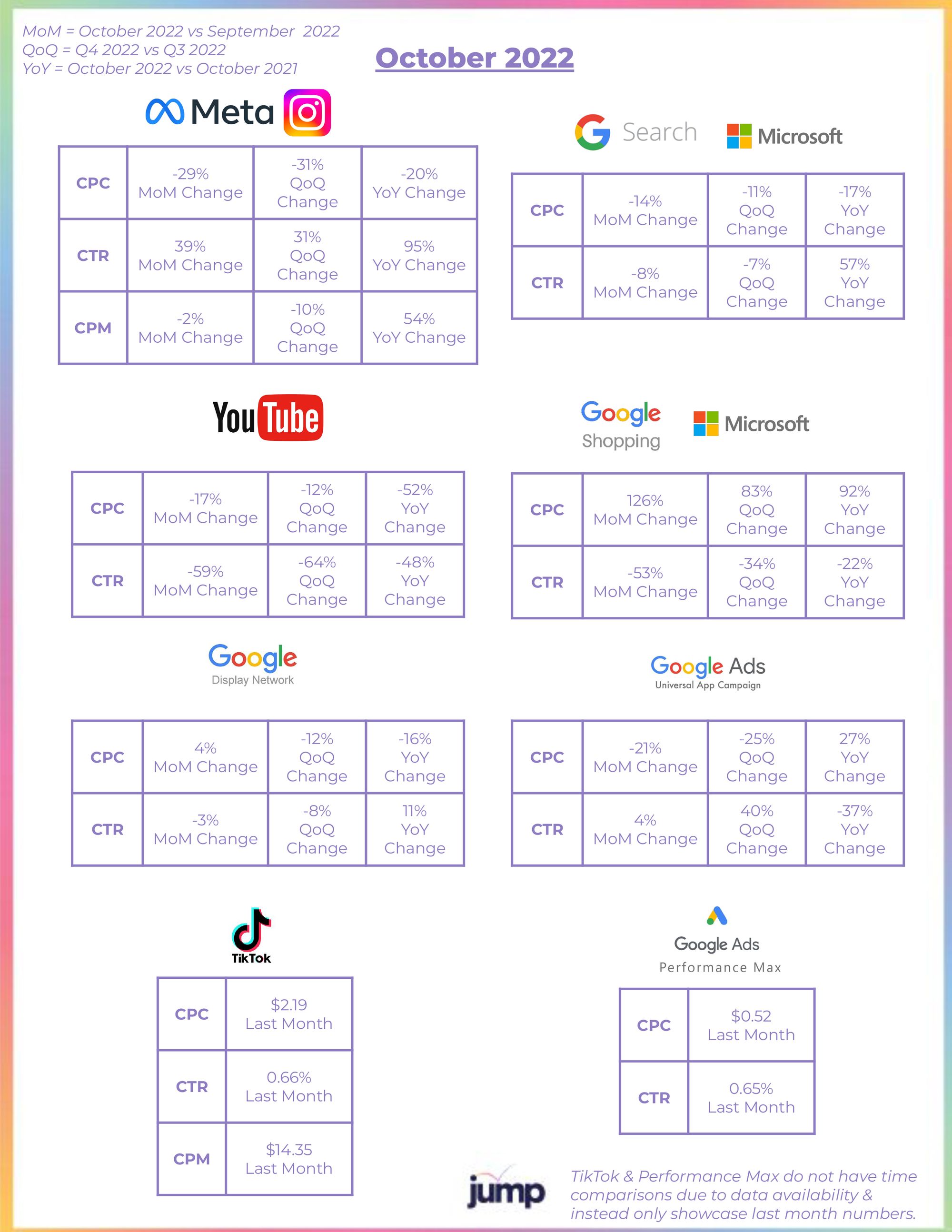

Our October 2022 Jump Analytics Paid Media Benchmarks Report is now out! This report encompasses hundreds of millions of dollars of spend, clicks, and impressions over the past year across all Jump clients and verticals. This report delivered monthly showcases the CPC, CTR, & CPM trends over the past month, quarter, and year. Read to learn about our recent data insights on Facebook (Meta) & Instagram, Google & Bing across Search, Shopping, YouTube, Display, and TikTok.

Key Trends

● Minimal change in Meta CPM MoM indicates no spend pullbacks as Meta remains one of the top channels for Brand & Direct Response advertisers, especially before the Q4 rush

● Shopping CPCs up significantly MoM, QoQ, and YoY after 2 relatively low months in September & October signifying competition is starting to rise ahead of the Q4 rush

● Google Performance Max CPCs continue to drop almost reaching $0.50 on average while CPMs have remained fairly steady through the last 7 months; performance still is a mixed bag though for down funnel conversions

● Google Display CPCs down 16% while CTR is up 11% YoY

What to Watch For

● Twitter investment to be allocated towards other social platforms such as Meta, TikTok, and Snap as brand advertisers navigate high uncertainty & brand safety issues on Twitter

● Lower Conversion Rate expected during the first half of November as users may patiently wait for Black Friday/Cyber Monday deals

● Rollout of Meta Advantage+ Shopping Campaigns (ASC) to accounts & the migration from standard campaigns to ASC

● More automation tools from Google continuing to roll out to "simplify" campaign management, which leads to less control over placements and data visibility

● Any YouTube changes that might be a reaction to lower revenues in their latest earnings report