By Tom Murray | Managing Director

For the past few weeks and months, all eyes were on the Presidential election. There were changes to the way the candidates could promote their ads, and some platforms even banned political ads. But one of the platforms that let pretty much anything go was Facebook.

From August 19 through Election Day, can you guess how many dollars were spent on political advertising?

784 MILLION DOLLARS.

I will let that sink in for a moment.

Now not all of those ads were spent on the presidential race, as this includes senate races, as well as lobbyist organizations that were deemed political.

By the last week or two of the election, there was $100 MILLION spent in consecutive weeks as we got closer to the day of voting.

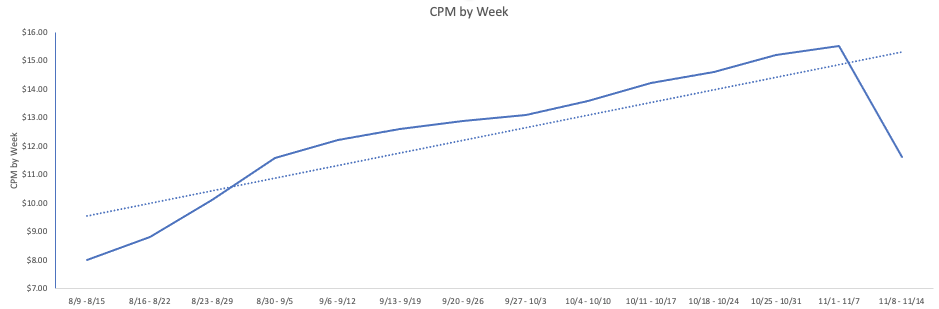

All of this spending caused havoc on CPMs on Facebook starting in September and October. We saw CPMs across all of our accounts, which makes up tens of millions of spend, go up across the board. From it’s low point 12 weeks before the election (August 9th), we saw CPMs on Facebook rise from a total of $8 to as high as $15.50 during Election Week, an overall increase of 94%! Notice that CPMs did drop about 25% the week following Election Week as well.

All of these extra political ads caused CPMs to skyrocket as the races heated up.

But was this the only reason for the rise? Logic might say yes, but during this crazy year with the pandemic, there are a few other external factors here that also impacted CPMs.

- Ad Boycotts: Many of the biggest brands turned off their ads during the month of July, with many turning their campaigns back on gradually over time during the following months. Some brands are still paused now (Coke, Unilever, etc) but many couldn’t turn their ads off for that long since Facebook is a primary marketing channel. As these advertisers came back on line, more competition was seen, which would raise costs.

- More Advertisers: More small businesses flocked to Facebook to try to gain business. Facebook tends to add around 1 Million advertisers a year to the platform, and started this year with 8 Million. By November, they had 10 Million, which means they added 2x the advertisers they typically see on a yearly basis. Even if these small businesses have low budgets, they are still competing for ad space against even the largest of spenders, and all those ads in the auction will mean that costs go up unless the supply of ads (ad load) increases.

- Q4 Testing: Often, October is used by heavy retail brands to test out creatives and start building retargeting pools for their bigger Q4 campaigns during Black Friday and Cyber Monday. With these brands testing, that means more competition, especially for some of the key objectives such as traffic and conversions.

- Brick and Mortar Shift: As brands had to rebuild their business overnight to move online and process digital orders, more advertising online was being done compared to more traditional channels such as out-of-home ads or billboards, since people were staying inside. This increased demand in the auctions could also increase prices.

So while the election definitely caused some CPM increases, there are a few other reasons why this might have occurred and just know that ALL advertisers for the most part saw these increases. They were painful for some advertisers, but if you are reading this and curious if things will go back to “normal” on Facebook, I hate to break it to you, but these price increases are not going away anytime soon. Facebook will keep getting more cluttered with advertisers and prices will keep going up. Instead, look to other channels - both social and non-social - in order to diversify your media mix and your reliance on the Facebook platform. Some of those platforms include Google (YouTube, Display, Discovery), Yahoo Gemini, Reddit, Quora, and countless others.